Business

IEA leader issues new decree on development of trade and industry

Supreme leader of the Islamic Emirate of Afghanistan (IEA) Mawlawi Hibatullah Akhundzada issued a decree on Monday approving measures to boost trade, increase exports, establish sustainable and stable relations with neighboring and regional countries, as well as supporting and promoting the private sector and domestic production.

According to the decree, the ministries and relevant agencies are obliged to provide necessary facilities for trade in ports, transit points and highways, taking into account the commercial and economic interests of the country.

The decree also said that officials and employees of ministries and emirate agencies in the capital and provinces are obliged to treat the private sector well – in accordance with the applicable legal documents of the country and to avoid delay in the related proceedings.

Ministries and agencies are obliged to use the domestic products of the country as much as possible in accordance with the growth and self-sufficiency of the internal industries of the country, read the decree.

Business

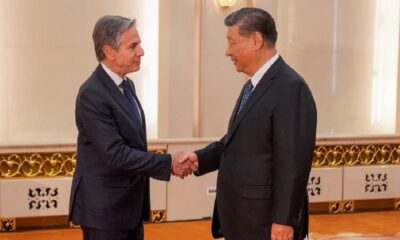

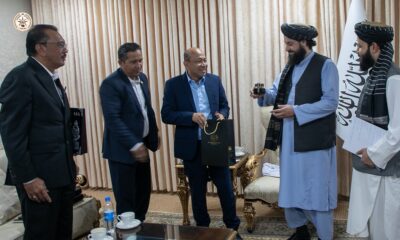

Azizi calls on Malaysian investors to invest in Afghanistan

Nooruddin Azizi, Acting Minister of Commerce and Industry, met with representatives from the ministries of foreign affairs, defense and interior of Malaysia, along with other senior officials, on Wednesday and called on Malaysians to invest in Afghanistan.

The visiting delegation is being led by senior diplomat Dr. Shazelina Zainul Abidin.

According to the IEA’s foreign ministry, the two sides discussed bilateral trade, holding a business communication conference to strengthen trade relations between the two countries, the trade balance between Afghanistan and Malaysia, and creating a market for Afghan products, including carpets, cotton, and minerals.

According to the ministry, at the end of the meeting, the Acting Minister emphasized the increase of investment from regional countries in Afghanistan and called on Malaysian investors to also invest in Afghanistan.

Business

Afghanistan starts exporting via railway to Turkey

The Ministry of Interior says that Afghanistan has started exporting goods to Turkey via the Herat-Khaf railway line.

In a post on X, the ministry said: “Afghanistan’s exports to Turkey started in a calm atmosphere through the Herat-Khaf railway line.”

The ministry added that one train will run daily for a month and then two trains will run daily.

According to the ministry, the security of Khaf-Herat railway line is provided by the guards of the National Public Protection Agency.

Khaf-Herat railway project not only connects Iran and Afghanistan by rail, but also completes a 2,000-kilometer route along the east-west rail corridor from China, through Uzbekistan, to Afghanistan, to Iran, and on to Turkey and Europe.

As a landlocked country, this railway network will provide a safe route to connect with Europe via Iran’s railway network and Iran’s southern ports.

This railway line is strategic for trade between Iran and Afghanistan and will allow six million tons of goods to be sent between the two countries.

Business

Afghanistan, Kazakhstan to hold joint expo in Kabul

A joint expo between Afghanistan and Kazakhstan will be held in Kabul in the next four days, officials said on Sunday.

Officials of the Ministry of Industry and Commerce said that the two-day expo will be held for the purpose of expanding and strengthening trade relations between the two countries.

“This expo will be held as a follow-up of the Kazakh-Afghan international expo, which was held in the city of Astana, Kazakhstan, with the participation of a large delegation of the government and the private sector of the Islamic Emirate of Afghanistan,” Abdulsalam Javad Akhundzadeh, the spokesman of the Ministry of Industry and Commerce, said.

“At this expo, domestic products from different sectors of Afghanistan and the Republic of Kazakhstan will be put on display for two days.”

According to officials, 40 large Kazakh companies, and 40 large Afghan companies will exhibit their products.

Mohammad Saber Latifi, head of the Afghanistan International Expo Center, said that fruits, minerals and commercial services will be displayed at the expo.

During the expo, various memorandums of understanding for the trade of goods are also expected to be signed by companies.

-

Latest News3 days ago

Latest News3 days agoRashid Khan named AWCC’s brand ambassador

-

Regional4 days ago

Regional4 days agoIranian president lands in Pakistan for three-day visit to mend ties

-

Sport4 days ago

Sport4 days agoKolkata beat Bengaluru by one run in IPL as Kohli fumes at dismissal

-

Sport4 days ago

Sport4 days agoACL: Aino Mina 3-0 Istiqlal Kabul; Attack Energy 3-0 Khadim

-

Climate Change4 days ago

Climate Change4 days agoRescuers race to reach those trapped by floods in China’s Guangdong

-

Business5 days ago

Business5 days agoAfghanistan, Kazakhstan to hold joint expo in Kabul

-

World3 days ago

World3 days agoMalaysian navy helicopters collide in mid-air, 10 killed

-

Sport3 days ago

Sport3 days agoJaiswal ton powers Rajasthan to big IPL win