World

World’s poorest countries pushed to brink of collapse under China debt

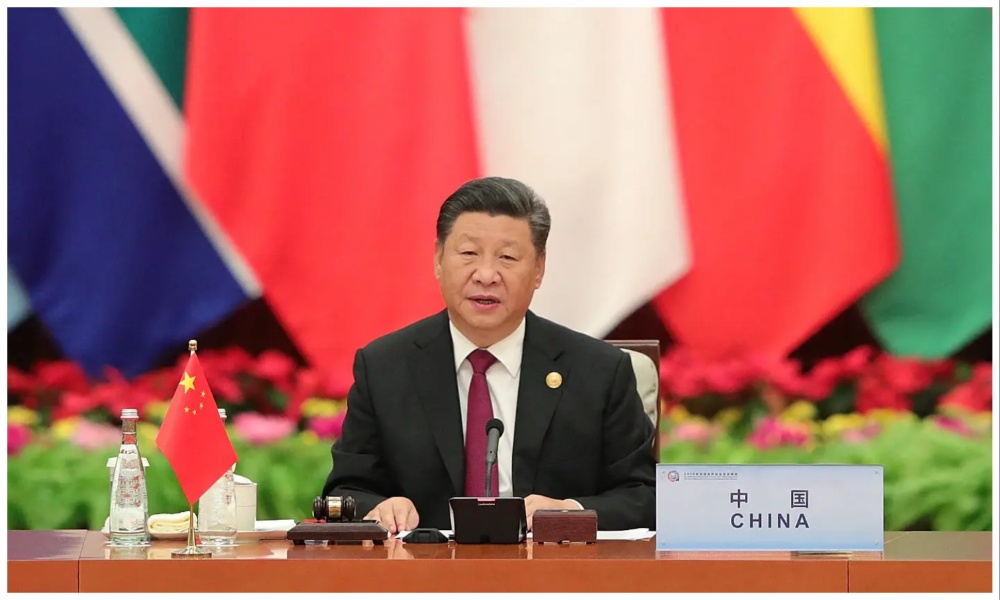

At least a dozen poor countries are buckling under the weight of hundreds of billions of dollars in debt, most of which is owed to China.

A recent analysis, carried out by the Associated Press, found that for a dozen countries, paying back their debt is consuming a growing amount of their tax revenue needed to keep basic services going.

Among the countries analyzed was Pakistan, Kenya, Zambia, Laos and Mongolia and it was found that paying back their debt is also draining foreign currency reserves that these countries use to pay interest on the loans – leaving some with just months before that money is gone.

AP reported that behind the scenes is China’s reluctance to forgive debt and its extreme secrecy about how much money it has loaned and on what terms, which has kept other major lenders from stepping in to help.

According to World Bank data analyzed by Statista recently, countries heavily in debt to China are mostly located in Africa, but can also be found in Central Asia, Southeast Asia and the Pacific.

And, Statista reports that the new Belt and Road Initiative, which finances the construction of port, rail and land infrastructure, has created much debt to China for participating countries, specifically poor countries.

As of March last year, 215 cooperation documents had been signed with 149 countries on the initiative.

Countries in AP’s analysis meanwhile had as much as 50% of their foreign loans from China and most were devoting more than a third of government revenue to paying off foreign debt.

Two of them, Zambia and Sri Lanka, have already gone into default, unable to make even interest payments on loans financing the construction of ports, mines and power plants.

In Pakistan, millions of textile workers have been laid off because the country has too much foreign debt and can’t afford to keep the electricity on and machines running, AP stated.

In Kenya, the government has held back paychecks to thousands of civil service workers to save cash to pay foreign loans. The president’s chief economic adviser tweeted last month, “Salaries or default? Take your pick.”

The study also found that since Sri Lanka defaulted a year ago, a half-million industrial jobs have vanished, inflation has risen by 50% and more than half the population in many parts of the country has fallen into poverty.

The study found that experts predict that unless China begins to soften its stance on its loans to poor countries, there could be a wave of more defaults and political upheavals.

AP’s report stated that a case study of how it has played out is in Zambia, a landlocked country of 20 million people in southern Africa that over the past two decades has borrowed billions of dollars from Chinese state-owned banks to build dams, railways and roads.

While the loans boosted Zambia’s economy, they also raised foreign interest payments so high that there was little left for the government, forcing it to cut spending on healthcare, social services and subsidies to farmers for seed and fertilizer.

In the past under such circumstances, big government lenders such as the U.S., Japan and France would work out deals to forgive some debt, with each lender disclosing clearly what they were owed and on what terms so no one would feel cheated.

But China didn’t play by those rules, AP reported. It refused at first to even join in multinational talks, negotiating separately with Zambia and insisting on confidentiality that barred the country from telling non-Chinese lenders the terms of the loans.

By late 2020, Zambia was unable to pay the interest and defaulted, setting off a cycle of spending cuts and deepening poverty.

Since then, inflation in Zambia has increased by 50%, unemployment has hit a 17-year high and the nation’s currency, the kwacha, has lost 30% of its value in just seven months. AP also found that 3.5 million Zambians are now not getting enough food.

AP reported that a few months after Zambia defaulted, researchers found that the country owed $6.6 billion to Chinese state-owned banks, double what many thought at the time and about a third of the country’s total debt.

China’s unwillingness however to take big losses on the hundreds of billions of dollars it is owed, as the International Monetary Fund and World Bank have urged, has left many countries on a treadmill of paying back interest, which stifles the economic growth that would help them pay off the debt.

For Pakistan, its foreign cash reserves have plunged more than 50%, according to AP’s analysis, while in nine of the 12 countries analyzed, foreign cash reserves have dropped on average of 25% in just one year.

Based on this, Pakistan for example has only two months left of foreign cash to pay for food, fuel and other essential imports if it does not get a bailout. Other countries, such as Mongolia, have eight months left.

AP found that last month, Pakistan was so desperate to prevent more blackouts that it struck a deal to buy discounted oil from Russia, breaking ranks with the US-led effort to shut off Vladimir Putin’s funds.

In Sri Lanka, rioters poured into the streets last July, setting homes of government ministers aflame and storming the presidential palace, sending the leader tied to onerous deals with China fleeing the country.

China has however disputed the idea that Beijing is an unforgiving lender and said in a statement that the Federal Reserve was to blame.

It said that if it is to accede to IMF and World Bank demands to forgive a portion of its loans, so should multilateral lenders, which it views as US proxies.

“We call on these institutions to actively participate in relevant actions in accordance with the principle of ‘joint action, fair burden’ and make greater contributions to help developing countries tide over the difficulties,” the statement said.

But China’s approach to lending is widely considered more transactional and criticized as “opaque” and analysts see Beijing’s desire to access oil, minerals and other commodities as the driving force behind Chinese lenders being less prone to applying strict conditions in helping governments finance roads, bridges and railroads – so as to unlock those resources.

Just last month, US Treasury Secretary Janet Yellen told lawmakers: “I’m very, very concerned about some of the activities that China engages in globally, investing in countries in ways that leave them trapped in debt and don’t promote economic development.”

“We are working very hard to counter that influence in all of the international institutions that we participate in,” she said.

Since 2017, China has become the world’s largest official creditor, surpassing the World Bank, IMF and 22-member Paris Club combined, Brent Neiman, a counselor to Yellen, said late last year.

Politico meanwhile reported earlier this month that China’s financing of projects in other countries between 2000 and 2017 totaled more than $800 billion, most of that in the form of loans.

But for some poor countries struggling to repay China, they now find themselves stuck in a kind of loan limbo: China won’t budge in taking losses, and the IMF won’t offer low-interest loans if the money is just going to pay interest on Chinese debt.

World

Hong Kong tycoon Jimmy Lai sentenced to 20 years in jail in national security trial

Hong Kong’s most prominent media tycoon Jimmy Lai was sentenced on Monday to a total of 20 years in jail on national security charges comprising two counts of conspiracy to collude with foreign forces and one of publishing seditious materials.

The sentence ends a legal saga spanning almost five years, and Hong Kong’s most high-profile national security hearing. Lai, founder of the now-shuttered Apple Daily newspaper, was first arrested in August 2020 and convicted last year, Reuters reported.

Lai’s sentence of 20 years was within the most severe penalty “band” of 10 years to life imprisonment for offences of a “grave nature”.

The Hong Kong court said Lai’s sentence was enhanced by the fact that he was “mastermind” and driving force behind foreign collusion conspiracies.

The 78-year-old, a British citizen, has denied all the charges against him, saying in court he is a “political prisoner” facing persecution from Beijing.

Lai’s plight has been criticised by global leaders, opens new tab including U.S. President Donald Trump and British Prime Minister Keir Starmer, spotlighting a years-long national security crackdown in the China-ruled Asian financial hub, following mass pro-democracy protests in 2019.

“The rule of law has been completely shattered in Hong Kong. Today’s egregious decision is the final nail in the coffin for freedom of the press in Hong Kong,” said Jodie Ginsberg, CEO of the Committee to Protect Journalism.

“The international community must step up its pressure to free Jimmy Lai if we want press freedom to be respected anywhere in the world.”

Lai arrived to court in a white jacket, with hands held together in a praying gesture as he smiled and waved at supporters.

The case has drawn calls for the long-standing critic of the Chinese Communist Party, who friends and supporters say is in frail health, to be freed.

“The harsh 20-year sentence against 78-year-old Jimmy Lai is effectively a death sentence,” said Elaine Pearson, Asia Director of Human Rghts Watch. “A sentence of this magnitude is both cruel and profoundly unjust.”

Dozens of Lai’s supporters queued for several days to secure a spot in the courtroom, with scores of police officers, sniffer dogs and police vehicles including an armoured truck and a bomb disposal van deployed around the area.

“I feel that Mr. Lai is the conscience of Hong Kong,” said a man named Sum, 64, who was in the queue.

“He speaks up for Hong Kong people, and even for many wrongful cases in mainland China and for the development of democracy. So I feel that spending a few days of my own freedom sleeping out here is better than seeing him locked up inside.”

Starmer raised the case of Lai, who holds British citizenship, in detail during a tête-à-tête with Chinese leader Xi Jinping last month in Beijing’s Great Hall of the People, according to people briefed on the discussions. Britain’s national security adviser, Jonathan Powell, and China’s foreign minister, Wang Yi, were also present.

“I raised the case of Jimmy Lai and called for his release,” Starmer told the UK parliament after his trip.

Trump too, raised Lai’s case with Xi during a meeting last October. Several Western diplomats told Reuters that negotiations to free Lai would likely begin in earnest after he is sentenced, and depending on whether Lai will appeal.

LIFE IN PRISON?

Lai’s family, lawyer, supporters and former colleagues have warned that he could die in prison as he suffers from health conditions including heart palpitations and high blood pressure.

Besides Lai, six former senior Apple Daily staffers, an activist and a paralegal will also be sentenced.

“Jimmy Lai’s trial has been nothing but a charade from the start and shows total contempt for Hong Kong laws that are supposed to protect press freedom,” said the Committee to Protect Journalists’ Asia-Pacific Director Beh Lih Yi.

Beijing, however, says Lai has received a fair trial and all are treated equally under the national security law that has restored order to the city.

World

Trump signs order threatening tariffs on nations doing business with Iran

U.S. President Donald Trump signed an executive order on Friday that may impose a 25% tariff on countries that do business with Iran.

The order comes as tensions between Iran and U.S. continue to simmer even as the two countries engaged in talks this week.

World

Trump rejects Putin offer of one-year extension of New START deployment limits

U.S. President Donald Trump on Thursday rejected an offer from his Russian counterpart to voluntarily extend the caps on strategic nuclear weapons deployments after the treaty that held them in check for more than two decades expired.

“Rather than extend “New START … we should have our Nuclear Experts work on a new, improved and modernized Treaty that can last long into the future,” Trump wrote in a post on his Truth Social platform, Reuters reported.

Arms control advocates warn that the expiration of the treaty will fuel an accelerated nuclear arms race, while U.S. opponents say the pact constrained the U.S. ability to deploy enough weapons to deter nuclear threats posed by both Russia and China.

Trump’s post was in response to a proposal by Russian President Vladimir Putin for the sides to adhere for a year to the 2010 accord’s limit of 1,550 warheads on 700 delivery systems — missiles, aircraft and submarines.

New START was the last in a series of arms control treaties between the world’s two largest nuclear weapons powers dating back more than half a century to the Cold War. It allowed for only a single extension, which Putin and former U.S. President Joe Biden agreed to for five years in 2021.

In his post, Trump called New START “a badly negotiated deal” that he said “is being grossly violated,” an apparent reference to Putin’s 2023 decision to halt on-site inspections and other measures designed to reassure each side that the other was complying with the treaty.

Putin cited U.S. support for Ukraine’s battle against Russia’s 2022 full-scale invasion as the reason for his decision.

White House spokeswoman Karoline Leavitt told reporters that the U.S. would continue talks with Russia.

BOTH SIDES SIGNAL OPENNESS TO TALKS

Earlier, Kremlin spokesman Dmitry Peskov said Russia was still ready to engage in dialogue with the U.S. if Washington responded constructively to Putin’s proposal.

“Listen, if there are any constructive replies, of course we will conduct a dialogue,” Peskov told reporters.

The UN has urged both sides to restore the treaty.

Besides setting numerical limits on weapons, New START included inspection regimes experts say served to build a level of trust and confidence between the nuclear adversaries, helping make the world safer.

If nothing replaces the treaty, security analysts see a more dangerous environment with a higher risk of miscalculation. Forced to rely on worst-case assumptions about the other’s intentions, the U.S. and Russia would see an incentive to increase their arsenals, especially as China plays catch-up with its own rapid nuclear build-up.

Trump has said he wants to replace New START with a better deal, bringing in China. But Beijing has declined negotiations with Moscow and Washington. It has a fraction of their warhead numbers – an estimated 600, compared to around 4,000 each for Russia and the U.S.

Repeating that position on Thursday, China said the expiration of the treaty was regrettable, and urged the U.S. to resume dialogue with Russia on “strategic stability.”

UNCERTAINTY OVER TREATY EXPIRY DATE

There was confusion over the exact timing of the expiry, but Peskov said it would be at the end of Thursday.

Russia’s Foreign Ministry said Moscow’s assumption was that the treaty no longer applied and both sides were free to choose their next steps.

It said Russia was prepared to take “decisive military-technical countermeasures to mitigate potential additional threats to national security” but was also open to diplomacy.

That warning was in apparent response to the possibility that Trump could expand U.S. nuclear deployments by reversing steps taken to comply with New START, including reloading warheads on intercontinental ballistic missiles and submarine-launched missiles from which they were removed.

A bipartisan congressionally appointed commission in 2023 recommended that the U.S. develop plans to reload some or all of its reserve warheads, saying the country should prepare to fight simultaneous wars with Russia and China.

Ukraine, which has been at war with Russia since Moscow’s 2022 invasion, said the treaty’s expiry was a consequence of Russian efforts to achieve the “fragmentation of the global security architecture” and called it “another tool for nuclear blackmail to undermine international support for Ukraine.”

Strategic nuclear weapons are the long-range systems that each side would use to strike the other’s capital, military and industrial centres in the event of a nuclear war. They differ from so-called tactical nuclear weapons that have a lower yield and are designed for limited strikes or battlefield use.

If left unconstrained by any agreement, Russia and the U.S. could each, within a couple of years, deploy hundreds more warheads, experts say.

“Transparency and predictability are among the more intangible benefits of arms control and underpin deterrence and strategic stability,” said Karim Haggag, director of the Stockholm International Peace Research Institute.

-

Latest News3 days ago

Latest News3 days agoAfghanistan to grant one- to ten-year residency to foreign investors

-

Sport4 days ago

Sport4 days agoIndonesia shock Japan to reach historic AFC Futsal Asian Cup final

-

Sport3 days ago

Sport3 days agoIran clinch AFC Futsal Asian Cup 2026 in penalty shootout thriller

-

Latest News4 days ago

Latest News4 days agoAfghanistan says Pakistan is shifting blame for its own security failures

-

International Sports2 days ago

International Sports2 days agoWinter Olympics gain momentum as medal table takes shape

-

Latest News3 days ago

Latest News3 days agoTraffic police receive new cars

-

Regional4 days ago

Regional4 days agoIran’s FM calls Oman-mediated talks with US ‘good start’

-

Latest News2 days ago

Latest News2 days agoTajik foreign minister urges international community to help Afghanistan address its challenges