Business

Conference on Islamic microfinance kicks off in Kabul

The four-day conference will discuss topics related to Islamic finance in Afghanistan, microfinance, job creation, poverty reduction, and financial inclusion.

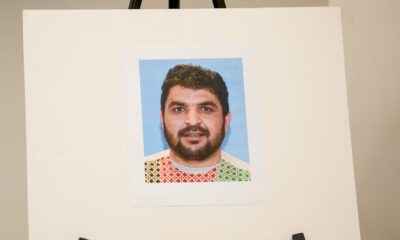

A conference focusing on Islamic microfinance under the title ‘Islamic Finance Week of Afghanistan’ got underway in Kabul on Monday.

The conference, organized by the United Nations Development Program (UNDP) has brought together representatives of Da Afghanistan Bank (DAB), the Ministry of Industry and Commerce, UNAMA, ambassadors from some countries, representatives of the private sector, commercial banks, microfinance institutions, and representatives of various other financial and banking institutions, DAB said in a statement.

The four-day conference will discuss topics related to Islamic finance in Afghanistan, microfinance, job creation, poverty reduction, and financial inclusion.

Sidiqullah Khalid, the Director General of the Governor’s Office of DAB, said that despite many challenges, the Islamic banking sector is still in a developing and stable condition.

He added that guidelines and frameworks for transitioning from conventional banking to Islamic banking, adapted to Afghanistan’s conditions, have been developed by utilizing the experiences of other Islamic countries.

According to him, the level of public trust in banks is increasing day by day, and significant steps will be taken soon in the area of financial development.

“DAB has relations with several international institutions that work in the field of Islamic finance and banking, and DAB will also utilize the standards, financial products, and training programs of these international institutions, along with the experiences of other Islamic countries, to further strengthen the Islamic banking in the country,” he said.

Khalid also stated that microfinance institutions play an important role in diversifying financial products, particularly in providing access to financial products for small businesses, agricultural growth for farmers, facilitating business opportunities for small entrepreneurs, reducing poverty levels, creating job opportunities, and overall contributing to the economic growth and development of the country.

He added that the bank has developed and finalized a framework for the regulation and supervision of this sector. Individuals in all provinces of the country who wish to provide services to the citizens through microfinance institutions can obtain a license from DAB.

Related stories:

Doha meeting on Afghanistan to focus on private sector, finance, banking, drugs: IEA

Afghanistan’s central bank chief upbeat over stable AFN

Business

Afghanistan seeks expanded ties with Russia in energy, mining and infrastructure

TASS reported that Kabul is also prepared to cooperate with Moscow in the extraction of mineral resources.

Afghanistan has expressed strong interest in broadening trade and economic cooperation with Russia, with a particular focus on energy, mining and infrastructure projects, according to Russia’s TASS news agency.

In an interview with TASS, Afghanistan’s Ambassador to Moscow, Gul Hassan, said Kabul is keen to import oil and gas from Russia as part of efforts to deepen bilateral economic ties.

He noted that trade relations between the two countries are progressing and that, if key obstacles—especially banking restrictions—are addressed, Afghanistan could also import medicines, industrial goods, grain, vegetable oils and other commodities from Russia.

In return, the ambassador said Afghanistan is ready to export fresh and dried fruits, vegetables, medicinal plants, carpets and mineral resources to the Russian market, adding that expanding export-import operations could significantly increase bilateral trade volumes.

He also revealed plans to open an exhibition of Afghan products in Moscow, which he said would help boost trade turnover.

TASS reported that Kabul is also prepared to cooperate with Moscow in the extraction of mineral resources.

Hassan described the economy as a central pillar of Afghanistan’s foreign policy, emphasizing the government’s goal of positioning the country as a key link in regional economic integration and attracting foreign investment.

He noted that Russian companies have long shown interest in Afghanistan’s industrial, mining and infrastructure sectors.

The ambassador further told TASS that Russian firms are already in talks with relevant Afghan authorities on the construction of small hydroelectric power plants.

Representatives of several Russian companies have reportedly visited Afghanistan and held meetings with officials and technical experts.

According to Hassan, practical steps toward cooperation in the energy and power generation sectors are expected in the near future, pointing to a potential new phase in Afghan-Russian economic relations.

Business

Pakistan, China plan to extend CPEC to Afghanistan, revive trilateral framework

The proposed CPEC expansion into Afghanistan is seen as a move to enhance regional economic integration amid shifting geopolitical dynamics.

Pakistan and China are moving forward with plans to extend the China-Pakistan Economic Corridor (CPEC) into Afghanistan, a strategic step aimed at bolstering regional connectivity and economic cooperation. The expansion, along with the revival of the Pakistan-China-Afghanistan trilateral framework, was discussed in a recent briefing to the Pakistani Senate Standing Committee on Foreign Affairs.

According to Pakistan Today, officials from Pakistan’s Ministry of Foreign Affairs outlined the details during a session in Islamabad, where they reviewed key aspects of Pakistan’s foreign relations, regional developments, and economic diplomacy.

Officials emphasized that Pakistan’s relationship with China remains strong, underscoring the “all-weather” strategic partnership between the two nations. Strengthening ties with Beijing, they stated, continues to be a cornerstone of Pakistan’s foreign policy. This includes unwavering support for China’s position on regional and international issues, particularly the One-China policy and matters related to territorial integrity.

The briefing also touched upon China’s consistent backing of Pakistan in various areas, including sovereignty, economic stability, counter-terrorism, and support for Pakistan’s exit from the Financial Action Task Force (FATF) grey list.

The Kashmir issue was also addressed, with officials noting that China considers it an unresolved matter and advocates for a peaceful resolution in line with UN Security Council resolutions.

The proposed CPEC expansion into Afghanistan is seen as a move to enhance regional economic integration amid shifting geopolitical dynamics. Officials stated that reviving the trilateral framework is part of broader efforts to foster greater cooperation and connectivity in the region, with an eye on long-term stability and prosperity.

The move also reflects both countries’ desire to further integrate Afghanistan into the regional economic landscape, a key element in fostering peace and development.

Business

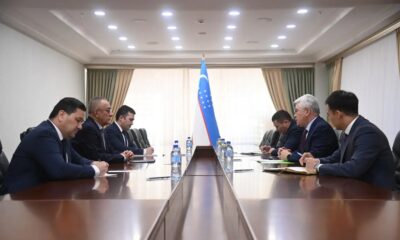

Uzbekistan–Afghanistan trade rises to $1.6 billion in 2025

Trade relations remain largely export-driven, with Uzbekistan supplying Afghanistan primarily with food products, energy resources, and industrial goods.

Trade between Uzbekistan and Afghanistan rose sharply in 2025, reaching $1.6 billion, according to official data released by Uzbekistan’s National Statistics Committee.

The figure represents a 45.5 percent increase from $1.1 billion in 2024 and an 84.4 percent rise compared with 2023, when bilateral trade stood at $867.5 million, highlighting rapid growth in economic exchanges between the two countries.

Uzbekistan’s exports to Afghanistan accounted for the vast majority of the trade volume, totaling $1.5 billion, or 93.8 percent of overall bilateral turnover. Trade relations remain largely export-driven, with Uzbekistan supplying Afghanistan primarily with food products, energy resources, and industrial goods.

The surge in trade comes as Uzbekistan’s total foreign trade turnover reached $81.2 billion in 2025, reflecting broader efforts to expand and diversify external economic ties. By the end of the reporting period, Uzbekistan maintained trade relations with 210 countries.

China remained Uzbekistan’s largest trading partner, accounting for 21.2 percent of total trade, followed by Russia (16.0 percent), Kazakhstan (6.1 percent), Türkiye (3.7 percent), and the Republic of Korea (2.1 percent).

The latest figures underscore strengthening economic ties between Uzbekistan and Afghanistan amid efforts to boost regional trade and connectivity.

-

Latest News2 days ago

Latest News2 days agoAfghanistan to grant one- to ten-year residency to foreign investors

-

Latest News4 days ago

Latest News4 days agoTerrorist threat in Afghanistan must be taken seriously, China tells UNSC

-

Sport3 days ago

Sport3 days agoIndonesia shock Japan to reach historic AFC Futsal Asian Cup final

-

Sport4 days ago

Sport4 days agoMilano Cortina 2026 Winter Olympics: What You Need to Know

-

Sport2 days ago

Sport2 days agoIran clinch AFC Futsal Asian Cup 2026 in penalty shootout thriller

-

Latest News4 days ago

Latest News4 days agoUS Justice Department to seek death penalty for Afghan suspect in National Guard shooting

-

Latest News2 days ago

Latest News2 days agoAfghanistan says Pakistan is shifting blame for its own security failures

-

Latest News4 days ago

Latest News4 days agoUzbekistan, Kazakhstan discuss cooperation on Afghanistan