Latest News

IEA opposes establishment of new fund to handle frozen assets

Afghanistan’s central bank, Da Afghanistan Bank (DAB), has slammed Washington’s decision to create a new international financing mechanism to distribute $3.5 billion worth of Afghanistan’s frozen assets, claiming the move was “unacceptable”.

On Wednesday, the US State Department announced that Washington, in coordination with international partners including the Government of Switzerland and Afghan economic experts, has established the Afghan Fund, which will see the money transferred to a Swiss bank.

On Thursday, DAB issued a statement asking for the decision to be reconsidered.

“Da Afghanistan Bank has measured any decision regarding the allocation, use or transfer of these reserves to achieve unrelated goals as unacceptable and requested [the US] to be reconsider it,” the statement said.

“Da Afghanistan Bank’s foreign exchange reserves are the property of the Afghan people and have been used for many years in the light of the law to maintain monetary stability, strengthen the financial system and facilitate trade with the world.

In a press briefing on Wednesday night, State Department spokesman Ned Price said: “Today, the Department of State and the Department of the Treasury, in coordination with international partners including the Government of Switzerland and Afghan economic experts, announced the establishment of a fund to benefit the people of Afghanistan.”

“This fund will protect and preserve the Afghan central bank reserves, while making targeted disbursements to help stabilize Afghanistan’s economy and, ultimately, support its people and work to alleviate the worst effects of the humanitarian crisis,” he said.

He stated the Islamic Emirate of Afghanistan (IEA) is “not a part of this financing mechanism and resources disbursed will be for the benefit of the Afghan people, with clear safeguards and auditing in place to protect against diversion or misuse.”

He said however that the Afghan Fund is “explicitly not intended to make humanitarian disbursements. The Afghan Fund itself is to facilitate macroeconomic stability inside Afghanistan.”

“This is not what that fund is for. This fund is to provide macroeconomic stability in Afghanistan that will enhance the effectiveness of humanitarian assistance from the United States and other donors.”

Former president of Afghanistan, Hamid Karzai, also disagreed with the decision and said any move to transfer the money to a third country was unacceptable and the assets should remain the “national treasure of the people” of Afghanistan.

Some experts however believe that by transferring the money to a fund of this nature is opening the way for wastage and the Afghan people will ultimately pay the price.

“From my point of view, the decision of the US government is very cruel to the Afghan national bank and Afghans should not be treated this way,” said Taj Mohammad Talash, an economic analyst.

Latest News

IEA ambassador meets top Chinese diplomat for Asia

Bilal Karimi, the Ambassador of the Islamic Emirate in Beijing, met on Thursday with Liu Jinsong, head of the Asian Department of China’s Ministry of Foreign Affairs, and Yue Xiaoyong, China’s Special Representative for Afghanistan. The officials discussed political, economic, and commercial relations between the two countries, the activation of the Wakhan corridor, consular affairs, and other related issues.

According to a statement from the Embassy of Afghanistan in China, Karimi praised China’s positive stance toward Afghanistan and considered cooperation between the two countries necessary.

The statement added that Liu and Yue, while respecting Afghanistan’s independence, territorial integrity, and sovereignty, also emphasized the continuation of cooperation.

Latest News

Afghanistan facing deepening hunger crisis after US Aid Cuts: NYT reports

Afghanistan has plunged deeper into a humanitarian crisis following sharp cuts to U.S. aid, with child hunger at its worst level in 25 years and nearly 450 health centers forced to close, the New York Times reported.

According to the report, U.S. funding — which averaged nearly $1 billion a year after the Islamic Emirate takeover in 2021 — has largely evaporated following the dismantling of the U.S. Agency for International Development (USAID) under President Donald Trump.

The World Food Program (WFP) estimates that four million Afghan children are now at risk of dying from malnutrition.

The aid cuts have hit rural areas particularly hard, leaving families without access to basic health care. In Daikundi province, the closure of local clinics has been linked to preventable deaths during childbirth and rising child mortality.

Nationwide, more than 17 million Afghans — about 40 percent of the population — face acute food insecurity, with seven provinces nearing famine conditions, the report said.

The crisis has been compounded by mass deportations of Afghan refugees from Iran and Pakistan, deadly earthquakes, and ongoing drought. While other donors and Afghan authorities have tried to fill the gap, their efforts fall far short of previous U.S. assistance, the NYT reported.

Humanitarian groups warn the impact will be long-lasting. Researchers cited by the New York Times say sustained malnutrition could damage an entire generation, with consequences that cannot be reversed even if aid resumes in the future.

However, the spokesperson of the Islamic Emirate, Zabihullah Mujahid, considers the findings of this report to be inaccurate and said that the situation in Afghanistan is not as dire as it is portrayed, and that the country’s situation is moving toward improvement.

“In our view, this report is not correct. We have gone through difficult times and experienced problems such as a humanitarian crisis. At one point, we suffered very heavy casualties and our people faced many difficulties, but now the situation of most people is improving. The country’s economy is moving in a positive direction, to some extent job opportunities have been created for unemployed people, efforts are still ongoing, and Afghanistan’s economic resources have been revived,” said Mujahid.

Latest News

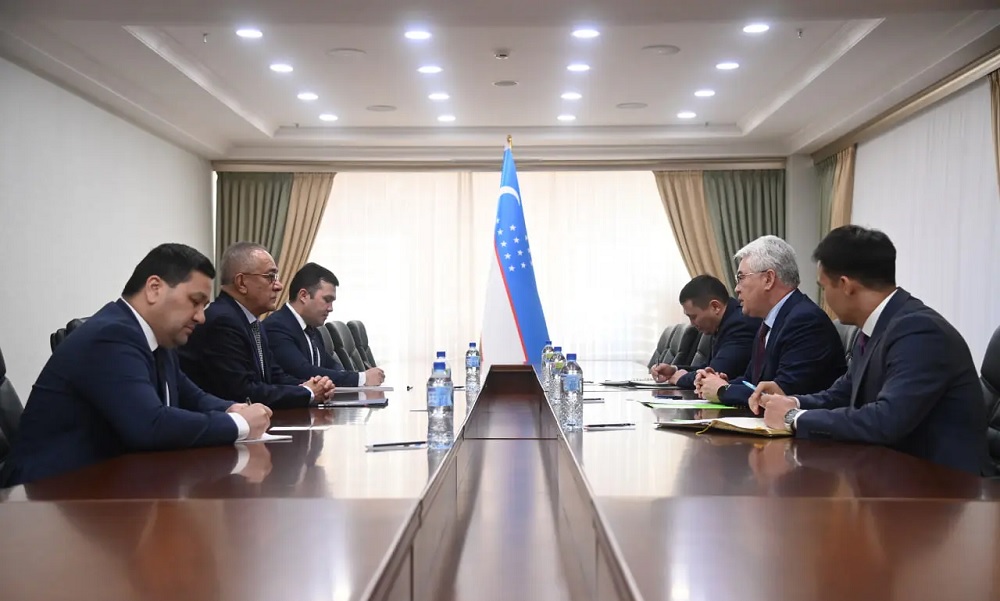

Uzbekistan, Kazakhstan discuss cooperation on Afghanistan

Ismatulla Irgashev, Special Representative of the President of Uzbekistan for Afghanistan, met on Tuesday with Beibut Atamkulov, Kazakhstan’s Ambassador to Uzbekistan, to discuss bilateral cooperation on Afghanistan.

The two sides highlighted their commitment to maintaining regular dialogue aimed at addressing the Afghan issue, according to a statement issued by Uzbekistan foreign ministry.

Atamkulov praised Uzbekistan’s efforts to help shape a unified regional position on Afghanistan.

The meeting also included discussions on involving Afghanistan in regional connectivity initiatives, particularly the implementation of the Trans-Afghan railway project.

Officials described the meeting as constructive and reaffirmed mutual interest in further developing practical cooperation between Tashkent and Astana.

-

Sport5 days ago

Sport5 days agoAFC Futsal Asian Cup: Afghanistan to face Iran in crucial Group D clash

-

Sport4 days ago

Sport4 days agoAFC Futsal Asian Cup 2026: Final eight confirmed

-

Sport4 days ago

Sport4 days agoAfghanistan in new kit for T20 World Cup warm-up against Scotland

-

Sport4 days ago

Sport4 days agoIran see off spirited Afghanistan to finish top of Group D

-

Sport2 days ago

Sport2 days agoJapan trumps Afghanistan 6-0 in AFC Futsal Asian Cup quarter-final

-

Sport2 days ago

Sport2 days agoHosts and heavyweights advance as AFC Futsal Asian Cup reaches semifinals

-

Regional5 days ago

Regional5 days agoGas leak caused blast in Iran’s Bandar Abbas, Iranian media say

-

International Sports3 days ago

International Sports3 days agoPakistan to boycott T20 World Cup group match against India