Latest News

IEA says US agreed not to give Afghan funds to charity organizations

After Washington announced its plan to use half of $7 billion in frozen Afghan assets for humanitarian aid, the Islamic Emirate of Afghanistan said on Friday the US has agreed not to give it to charity organizations.

The agreement came during a meeting between IEA’s Acting Foreign Minister Amir Khan Muttaqi and US special envoy for Afghanistan, Thomas West, in Turkey.

“The two sides held detailed discussions on current political & economic situation in Afghanistan. Both sides agreed that the Afghan Central Bank’s USD $3.5 billion unfrozen assets from the US bank shall in no circumstances be given to charity organizations,” Hafiz Zia Ahmad, deputy spokesman for Afghanistan’s foreign ministry, said on Twitter.

During the meeting, the Afghan side underscored that the entire $7 billion should be unfrozen and given to the Afghan central bank as it belongs to the Afghan people, he said.

Muttaqi stated that seizing Afghan assets in any way would adversely affect relations between the two countries, the tweet read.

Last month, US President Joe Biden signed an executive order creating the possibility of splitting $7 billion in frozen Afghan funds held in the US, potentially allotting half for humanitarian aid to the country while keeping the other half available for victims of the 9/11 attacks.

Meanwhile, former Afghan President Hamid Karzai in his latest interview with China’s CCTV, said the US should hand over all Afghan assets to the Afghan central bank.

Afghanistan has been suffering from a severe economic crisis and US freezing of Afghan funds and sanctions is considered to be a major factor behind it.

“If the money is given to foreign organizations, it would not be spent on infrastructure in Afghanistan. It is better to give the money to the finance ministry or the central bank of Afghanistan so that it would be used in infrastructure programs,” said Mohammad Shabir Bashiri, an economic expert.

Latest News

Economic Commission approves national policy for development of agriculture

At a regular meeting of the Economic Commission chaired by Mullah Abdul Ghani Baradar, Deputy Prime Minister for Economic Affairs, the National Policy for the Development of the Agriculture and Livestock Sector was approved.

According to a statement from the deputy PM’s office, the key objectives of the policy include the mechanization of the agriculture and livestock sector; development of agricultural, irrigation, and livestock research and extension systems; management of irrigation systems; support for investment in these sectors; and ensuring public access to high-quality agricultural and animal products.

During the same meeting, the development plan for the fish farming sector was also approved.

Under this plan, through private sector investment, 7,700 small, medium, and large fish production and farming facilities will be established on 6,500 hectares of land in various parts of the country.

The statement added that the implementation of this plan will create direct employment opportunities for 50,000 people and indirect employment for 250,000 others.

Latest News

Doha process private sector meeting highlights growth and coordination in Afghanistan

The session was divided into two segments, focusing on growth and inclusion in the first part, and coordination and transparency in the second.

The 3rd session of the Doha Process Private Sector Working Group was held both in-person and online at Kabul’s Grand Hotel, hosted by the United Nations Assistance Mission in Afghanistan (UNAMA).

The meeting brought together representatives from the Islamic Emirate of Afghanistan, including the Ministries of Foreign Affairs, Finance, Industry and Commerce, Economy, Labor and Social Affairs, and the Central Bank, alongside UNAMA, UN agencies, international and regional organizations, as well as ambassadors, diplomats, and private sector experts.

The session was divided into two segments, focusing on growth and inclusion in the first part, and coordination and transparency in the second.

Afghanistan’s Islamic Emirate representatives shared achievements and progress since assuming governance, while participants acknowledged these efforts and highlighted their ongoing support for the private sector. All parties offered recommendations to address challenges and emphasized enhanced cooperation moving forward.

International Sports

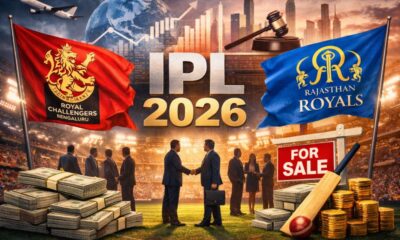

IPL 2026: Franchise sales gather pace as global investors circle teams

Royal Challengers Bengaluru (RCB) has been put on the market by its current owner and is estimated to be worth up to $2 billion.

Developments off the field are drawing growing attention ahead of the 2026 Indian Premier League season, with two franchises — Royal Challengers Bengaluru and Rajasthan Royals — formally up for sale and attracting interest from high-profile domestic and international investors.

Royal Challengers Bengaluru (RCB), one of the league’s most recognisable teams, has been put on the market by its current owner, Diageo’s United Spirits Ltd, following a strategic review. The sale process is expected to be completed by the end of March 2026. Market estimates suggest the franchise could be valued at around $2 billion, reflecting the soaring commercial value of the IPL.

Several bidders have been shortlisted for RCB, including investment groups led by Indian industrialists, private equity firms and overseas sports owners. Among those reported to have shown interest is a consortium linked to the Glazer family, co-owners of English Premier League club Manchester United. Non-binding bids have already been submitted, with binding offers expected in the coming weeks.

Rajasthan Royals (RR), winners of the inaugural IPL title in 2008, are also in the process of being sold. A shortlist of potential buyers has been finalised, featuring a mix of Indian and international investors, including private equity firms, entrepreneurs and media-linked groups. The franchise is expected to attract a valuation of more than $1 billion, according to market estimates.

Final bids for Rajasthan Royals are anticipated in early March, while the RCB transaction is expected to move into its final phase later this month. Any change in ownership will require approval from the Board of Control for Cricket in India (BCCI).

The potential sales mark one of the most significant ownership shake-ups in IPL history and underline the league’s growing appeal as a global sports investment as preparations continue for the 2026 season.

-

Latest News3 days ago

Latest News3 days agoAfghanistan to grant one- to ten-year residency to foreign investors

-

Sport4 days ago

Sport4 days agoIndonesia shock Japan to reach historic AFC Futsal Asian Cup final

-

Sport3 days ago

Sport3 days agoIran clinch AFC Futsal Asian Cup 2026 in penalty shootout thriller

-

Latest News3 days ago

Latest News3 days agoAfghanistan says Pakistan is shifting blame for its own security failures

-

International Sports2 days ago

International Sports2 days agoWinter Olympics gain momentum as medal table takes shape

-

Latest News5 days ago

Latest News5 days agoAfghanistan facing deepening hunger crisis after US Aid Cuts: NYT reports

-

World5 days ago

World5 days agoUS, Ukraine, Russia delegations agree to exchange 314 prisoners, says Witkoff

-

Latest News3 days ago

Latest News3 days agoTraffic police receive new cars