Latest News

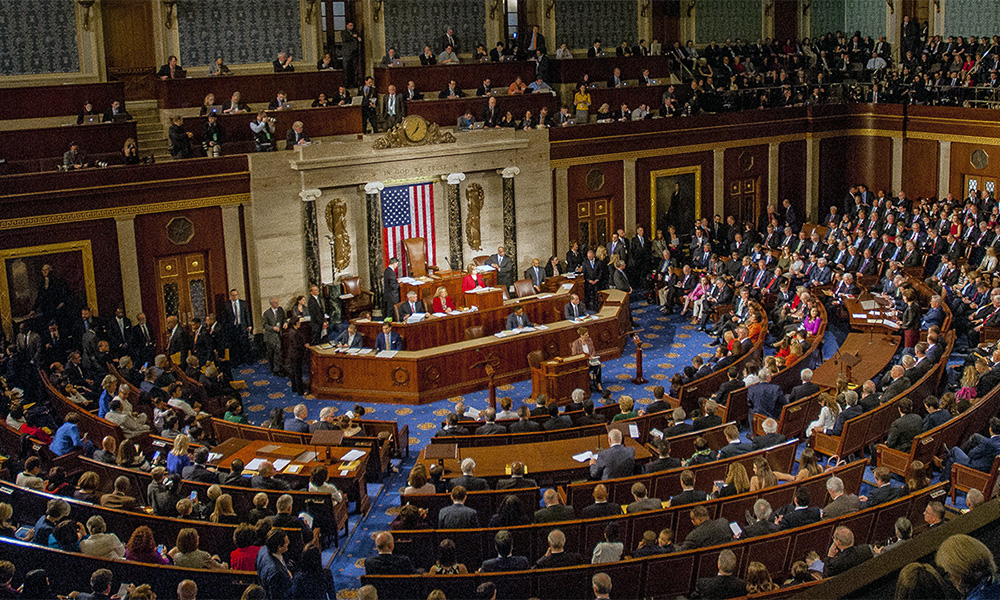

Muttaqi calls for cooperation in letter to US Congress

Afghanistan’s acting foreign minister Mawlawi Amir Khan Muttaqi warned Wednesday that continued “sanctions” will not help the current situation and could instead lead to a major crisis including a mass migration.

In a letter addressed to the United States Congress, Muttaqi said after suffering decades of war, the Afghan people now “have a right to financial security.”

“Currently the fundamental challenge of our people is financial security and the roots of this concern lead back to the freezing of assets of our people by the American government,” he said.

He also said that following the signing of the Doha Agreement in February last year, the Islamic Emirate of Afghanistan (IEA) “no longer find ourselves in direct conflict with one another nor are we a military opposition, what logic could possibly exist behind the freezing of our assets?”

“We believe that both sides have a great opportunity to build positive relations, moving forward and learn lessons from past bitter experiences. At a time when we have an excellent opportunity for positive relations, reaching for the option of sanctions and pressure cannot help improve our relations.”

He said the country now has a “united, responsible and non-corrupt government,” and that “practical steps have been taken towards good governance, security and transparency, islands of power have been eliminated, agents of corruption, embezzlement, usurpation and infringement of other rights have been neutralised, security has taken hold throughout the country, no threat is posed to the region or world from Afghanistan and a pathway has been paved for positive cooperation.”

“Afghanistan now has everything available for growth and development, and the United States of America can also invest in the manufacturing, agriculture and mining sectors of Afghanistan,” he said.

However, he said the IEA understands “the concerns of the international community and America, and it is necessary for both sides to take positive steps in order to build trust.”

Muttaqi also stated that freezing of assets and economic sanctions can harm health, education and other civil service systems and that this “will only harm the common Afghans and this will serve as the worst memory ingrained in Afghans at the hands of America.”

On the humanitarian crisis, Muttaqi stated that the country has already been hard hit by the coronavirus pandemic, drought, war and poverty and that the imposition of “sanctions” has hampered trade and impacted the process of providing humanitarian assistance.

“Assessments by the United Nations and other humanitarian organizations conclude that if these conditions continue, the Afghans will face a dire situation this winter,” he said.

He also pointed out that there was not “logical” justification for allowing women and children to suffer due to the lack of health services, food, shelter and other primary needs.

In calling for Afghanistan’s assets held by the United States to be released, he said he hopes Congress will take the matter seriously and consider the people.

“In conclusion, I request the government of the United States of America take responsible steps towards addressing the humanitarian and economic crisis unfolding in Afghanistan so that doors for future relations are opened, assets of Afghanistan’s Central Bank are unfrozen and sanctions on our banks are lifted.”

Latest News

Doha process private sector meeting highlights growth and coordination in Afghanistan

The session was divided into two segments, focusing on growth and inclusion in the first part, and coordination and transparency in the second.

The 3rd session of the Doha Process Private Sector Working Group was held both in-person and online at Kabul’s Grand Hotel, hosted by the United Nations Assistance Mission in Afghanistan (UNAMA).

The meeting brought together representatives from the Islamic Emirate of Afghanistan, including the Ministries of Foreign Affairs, Finance, Industry and Commerce, Economy, Labor and Social Affairs, and the Central Bank, alongside UNAMA, UN agencies, international and regional organizations, as well as ambassadors, diplomats, and private sector experts.

The session was divided into two segments, focusing on growth and inclusion in the first part, and coordination and transparency in the second.

Afghanistan’s Islamic Emirate representatives shared achievements and progress since assuming governance, while participants acknowledged these efforts and highlighted their ongoing support for the private sector. All parties offered recommendations to address challenges and emphasized enhanced cooperation moving forward.

International Sports

IPL 2026: Franchise sales gather pace as global investors circle teams

Royal Challengers Bengaluru (RCB) has been put on the market by its current owner and is estimated to be worth up to $2 billion.

Developments off the field are drawing growing attention ahead of the 2026 Indian Premier League season, with two franchises — Royal Challengers Bengaluru and Rajasthan Royals — formally up for sale and attracting interest from high-profile domestic and international investors.

Royal Challengers Bengaluru (RCB), one of the league’s most recognisable teams, has been put on the market by its current owner, Diageo’s United Spirits Ltd, following a strategic review. The sale process is expected to be completed by the end of March 2026. Market estimates suggest the franchise could be valued at around $2 billion, reflecting the soaring commercial value of the IPL.

Several bidders have been shortlisted for RCB, including investment groups led by Indian industrialists, private equity firms and overseas sports owners. Among those reported to have shown interest is a consortium linked to the Glazer family, co-owners of English Premier League club Manchester United. Non-binding bids have already been submitted, with binding offers expected in the coming weeks.

Rajasthan Royals (RR), winners of the inaugural IPL title in 2008, are also in the process of being sold. A shortlist of potential buyers has been finalised, featuring a mix of Indian and international investors, including private equity firms, entrepreneurs and media-linked groups. The franchise is expected to attract a valuation of more than $1 billion, according to market estimates.

Final bids for Rajasthan Royals are anticipated in early March, while the RCB transaction is expected to move into its final phase later this month. Any change in ownership will require approval from the Board of Control for Cricket in India (BCCI).

The potential sales mark one of the most significant ownership shake-ups in IPL history and underline the league’s growing appeal as a global sports investment as preparations continue for the 2026 season.

Latest News

FM Muttaqi meets Uzbek Central Asia Institute Chief, stresses stronger bilateral cooperation

During the meeting, the two sides discussed ways to further strengthen political and economic cooperation, as well as key regional issues.

Afghanistan’s Minister of Foreign Affairs, Amir Khan Muttaqi, has met with a delegation led by Joulan Vakhabov, head of Uzbekistan’s International Institute of Central Asia and adviser to the country’s deputy president.

During the meeting, the two sides discussed ways to further strengthen political and economic cooperation, as well as key regional issues.

Muttaqi said Uzbekistan has adopted a positive and goodwill-based policy toward Afghanistan, expressing hope that bilateral relations and cooperation would continue to expand.

He also underscored the important role of research institutions in promoting mutual understanding, enhancing cooperation, and developing a realistic assessment of regional dynamics.

For his part, Vakhabov praised the progress and stability in Afghanistan and voiced optimism that trade between the two countries would increase further in the current year.

-

Latest News3 days ago

Latest News3 days agoAfghanistan to grant one- to ten-year residency to foreign investors

-

Sport4 days ago

Sport4 days agoIndonesia shock Japan to reach historic AFC Futsal Asian Cup final

-

Sport5 days ago

Sport5 days agoMilano Cortina 2026 Winter Olympics: What You Need to Know

-

Sport3 days ago

Sport3 days agoIran clinch AFC Futsal Asian Cup 2026 in penalty shootout thriller

-

Latest News3 days ago

Latest News3 days agoAfghanistan says Pakistan is shifting blame for its own security failures

-

International Sports2 days ago

International Sports2 days agoWinter Olympics gain momentum as medal table takes shape

-

Latest News5 days ago

Latest News5 days agoAfghanistan facing deepening hunger crisis after US Aid Cuts: NYT reports

-

World5 days ago

World5 days agoUS, Ukraine, Russia delegations agree to exchange 314 prisoners, says Witkoff